So the new kids won the game and the old guard is crying. After printing their own profits for years, the hedge funds lost money. WTF? You can’t make rules, break them yourself and then blame someone else when you lose. I’ve often pointed how often people try to blame their losses on anyone but themselves, yet every profitable trade is just further proof of the genius at work. I’m not trying to save on word count here, so I’ll spell it out…Shaking My Head.

This is not the first short squeeze. This won’t be the last. And every time, there’s an outcry to take short selling out of the market? Why? Because a bunch of people on reddit decided to band together and make the same trade? I remember when we used to be told how cute it was when a group of old women got together and made trading clubs. They’d gather, share their research and decide as a group what to buy. Why is this one different? Because we don’t like the crowd that inflicted the pain? Because we want to protect the crowd that lost money? Maybe some of both?

We’re all pretty familiar already with what happened. ‘Hedge Funds’ were short some stocks, betting they’d go down based on their ‘value.’ Then the reddit crowd came in and bought up the stocks, squeezing the shorts or in old trading terms, giving them a facial. There are so many parts to this that this blog writes itself, though it might need installments. We can examine hedge funds and their trading missions. We can examine other short squeezes. We can examine Liquidation Only, possibly the equivalent of a long squeeze. And we can examine why the people shouting about banning short selling and exchanges deciding a stock’s ‘value’ are misinformed and really haven’t thought enough about their points of view.

Let’s start this by looking at those hedge funds that lost all that money. The guys we’re supposed to feel sorry for. Obviously, I don’t. A hedge fund, by definition, is supposed to hedge. In other words, they’re supposed to have laid off much of their risk by having some sort of counter position. Reason one to have no sympathy. If they were hedged, they wouldn’t need to get inflows of billions of dollars to stay in business. Understand, this is not Bernie Madoff. This money existed, still does, but has changed hands. Isn’t that what buying and selling is all about? Hedge funds rarely hedge. They take sides. Call it what you want. They buy or sell because they think something will go up or down. So, in effect, they’re gambling. Thing is, usually they’re more like the house…they win more often than they lose. But every once in a while even the largest casino loses to a whale. And then they don’t let him into the casino again. Kind of like when Robinhood shut down trading for the masses so the hedge funds wouldn’t lose more money.

It wasn’t that long ago, in fact, that hedge funds were actually the devils of Wall St. So to now turn it around seems like an argument of convenience against the new newcomers. The part about the reddit crowd being called reckless gamblers and the hedge funds being portrayed as the victims is really crazy. Seems to me they weren’t reckless, they were on a mission. To inflict pain.

I’ve told stories here before about the old commodity futures trading pits. Every once in a while, one trader would get pissed at another (well, that part happened all the time) and vow to inflict pain. People said things like, ‘I don’t care if it costs me 10 grand, I’m gonna make you lose 50!’ We called it running someone in. In this case, the reddit crowd was on a mission to run in the hedgies. And it worked! So now we need to change the rules? Maybe we should have changed them before; or at least followed the ones we have. I’ve been in this industry for a while, but I still don’t get how a stock that is shorted can be shorted to the tune of 140% of the outstanding float when shorts are supposed to borrow the shares. IOW, the shares you’re shorting need to exist, and be deliverable. So who was in the wrong?

Again, nothing new. 1922, Piggly Wiggly. More recent? Porsche, Herbalife, Tesla, etc. etc. etc. In 1980 there was a kind of a long squeeze, in fact. The Hunt brothers attempted to corner the silver market driving prices up to $50/ounce. This became a ‘problem’ and so the COMEX changes the rules on futures; it was called liquidation only. It meant silver would crash and the Hunt’s would be ruined. So while the Hunts were portrayed as the bad guys, it was the exchange Board of Directors that changed the rules mid-game.

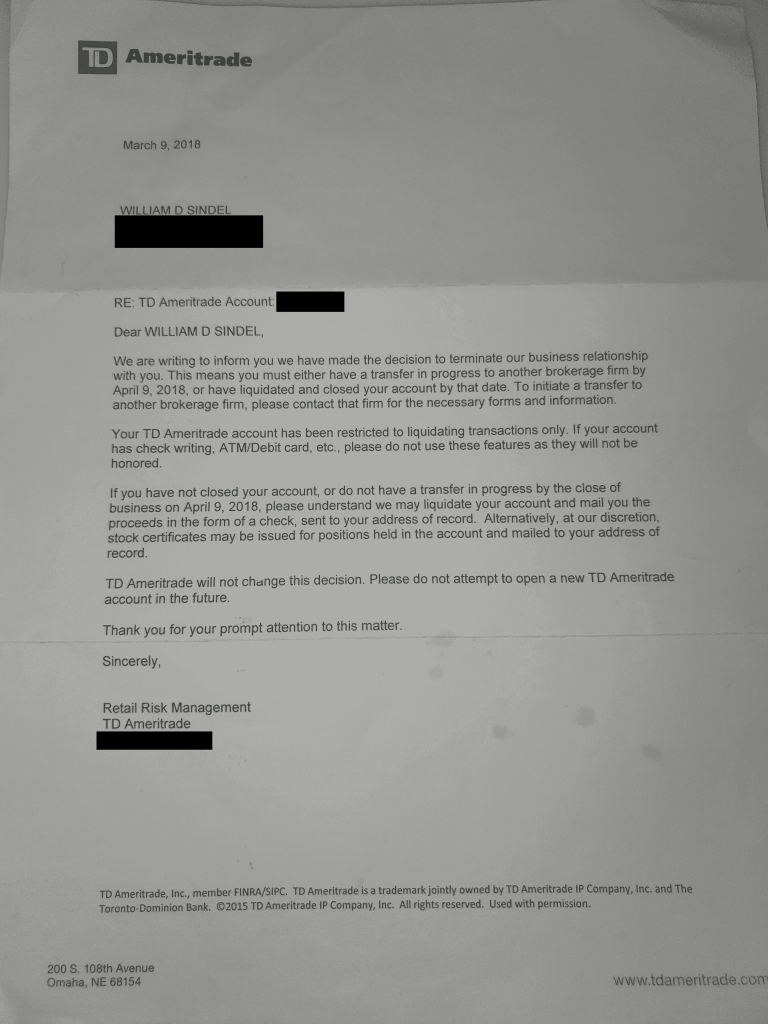

Robinhood wouldn’t let you trade? I know the issues they’ve spoken about around reserves. But few believe that; their position as one of many firms being paid to provide order flow was exposed and that sure seems to be a bigger problem than a bunch of r/wallstreetbets people getting long GameStop at the same time. This also is nothing new. I’ve had my own account shut down at TD Ameritrade. Why? While no one would provide an answer, I’m pretty convinced it was because we found a way to beat the firms that were paying for order flow at their own game. We were making money. Every Day. I was trading commission free, they were paying TDA for order flow. We both know who won.

Traditional Wall Street firms are like the kid in your neighborhood that as soon as they were losing, took their ball and went home. So why all the outrage? Why the call to protect them? Why are we going to ban short-selling, which anyone who’s actually participated in these markets is well aware adds more liquidity and serves to make markets actually more efficient. Why? Because the suits don’t like getting played by those ‘unprofessional reddit kids who don’t understand how this works.’ Actually, they do understand how this all works. So well, they were able to run you in. Deal with it. These markets aren’t guaranteeing profits, they’re guaranteeing opportunity. Will this end well? Probably not, but a lot of people have learned a lot about the realities of a somewhat free market. Now to go grab some more popcorn.