When I was a kid, this was the defense to someone calling Bullshit. You would brag, someone would call BS! and the response oftentimes was, ‘Oh yeah? Wanna bet?’ This was followed by some type of slim or imagined proof and then we all went back to what we were doing. My point in telling this very brief history is that betting, even in such a harmless boys sticking their chest out way, is bred into many a person’s psyche from the time they are a kid. When I lived in Hoboken NJ, one of my apartments was down the street from a known bookie joint masquerading as another (legitimate) business.

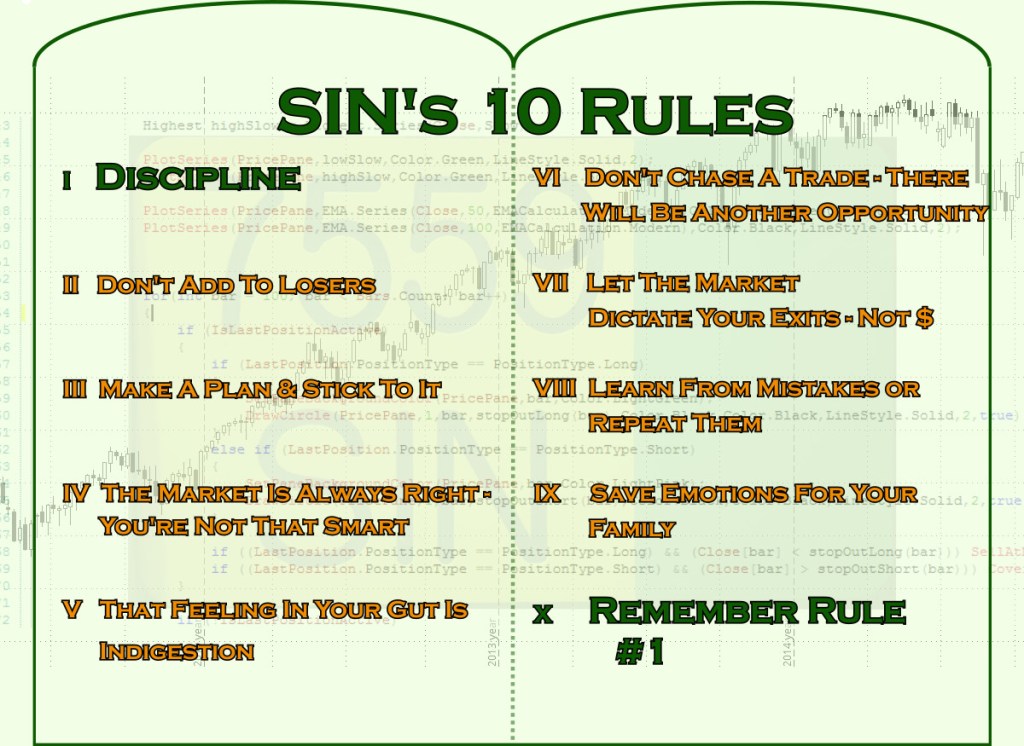

The good news was most of this was harmless. Were there always people with gambling problems? No doubt! But making it just a little bit of a chore to gamble stopped many people. Las Vegas and Atlantic City. That’s where the casinos were. On the trading floor we always had ‘pools’, the biggest being for the Super Bowl at $1,000 per box or more. Do the math; it was a bit degenerate. When I traded, many people tried to point out that I was gambling for a living. To some extent we were, but I used to explain we were the ‘House.’ We had a competitive edge and knew over time we’d come out ahead. That to me was way better than trying to figure out how many points one team would beat another by. Or worse, sitting on a casino floor pulling the lever on the slot machine. There’s a reason those machines are referred to as ‘One-armed bandits.’

Now, it’s a bit of a free for all. Or the wild, wild west as we used to call new trading markets introduced to the futures floor. The new ubiquity of gambling opportunities started with the expansion of the casino business itself. By allowing indigenous tribes of Native Americans to place casinos on their land, the dam was definitely starting to show signs of breaking. And then came DraftKings in 2012. Some sports gambling preceded them, but DraftKings was probably the first household name associated with online gambling. Even they didn’t start out that way. It was a platform for sports-based fantasy leagues set up amongst groups of friends. They usually involve a small buy in and a small prize at the end for the winning team…and sometimes an embarrassing or joke prize for last. If we think of the Native American casinos as the small holes in the dyke you use a finger to fill, this may have been the point at which we started running out of appendages.

Just like Netflix no longer resembles its original business (remember those DVD envelopes?), DraftKings might as well drop Draft from its name. It changed the ‘game’ when the Supreme Court, in 2018, allowed states to legalize and regulate sports gambling within their jurisdictions. That’s it. The dam is gone, the floodgates are open, and all hell has broken loose. One can no longer watch a sporting event without knowing who is favored to win and by how much. Add in ‘prop bets,’ the ability to bet on a micro event within the game and we’ve got, well, player and coach gambling scandals. Sure couldn’t see this one coming a mile (1.62km) away.

We worry about children and adolescents with unbridled social media. Australia has gone so far as to ban it. But there’s always a workaround, and the gambling ones are beyond simple. Speaking to people generations younger than me, they see this becoming a large societal issue. And when something becomes a ‘large societal issue,’ that society ends up bailing out the people with the issue. Does a 2pt font size warning about gambling problems really make a difference? A bit, I’m sure. Not enough, I’m also pretty positive. Tobacco comes to mind. The tobacco companies are not killing dividends and declaring bankruptcy after throwing a warning on the label. Neither does a casino. And if we believe someone under 18 (21) is too young to understand the magnitude of some responsibilities but still provide access, we are breeding a larger problem. And with that problem comes…here’s where I finally get away from moral pontificating…comes COST.

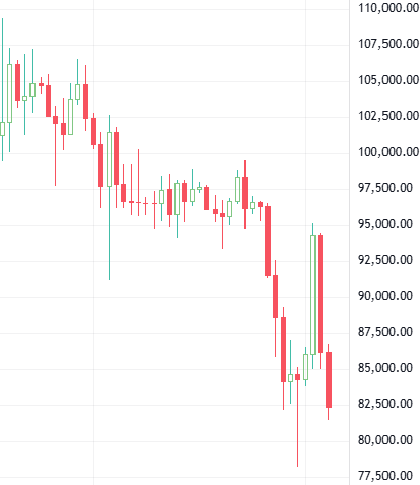

So what do we do about it? Well, currently, it seems we are expanding the ability to find more things to bet on. Definitely the wrong direction. Sometimes they are couched as ‘investment or trading vehicles,’ but in reality, it’s gambling. Prediction markets are the new golden child of products. We have old school ‘trad-fi’ (see last blog) exchanges and companies building or buying prediction markets. What are prediction markets? They allow you to place a binary ‘bet’ on an outcome. From elections to sporting events. Who will win? But these markets also allow for those micro ‘prop’ type bets. Will this person score more than ‘n’ points? Yes/No. Bet yes correctly, you win $1.00/per dollar bet. Bet incorrectly and you lose. And you can sell these bets, I mean positions. If one person is winning a political race, as the end gets closer and the polls move, so does the price of the ‘asset.’ In other words, it might cost me 30 cents to place a wager, because someone else disagrees so strongly that they will sell that opinion for $0.30 of an overall $1.00 market. They are essentially going short. Unless, originally, they bought that bet position for less, in which case they now have a profit. And as we get closer, or conditions change, I may be able to sell my $0.30 bet for $0.70. This can go on until the event ‘closes,’ i.e. election night.

The Wall Street reasoning? It behaves much like a swap or a futures contract but with no built-in ability to ‘roll’ your position. Except you can. Will the Fed lower rates by ‘this date’? That date comes and rates don’t change so you take a new position by simply making the same bet again. Well, that didn’t work, but will they then lower rates by a new date? Seems fair and harmless enough. But it isn’t. Ingrained gambling addictions don’t just vanish with some aging. They often get as bad as resources will allow. Why do I care so much about this that I was driven to write a blog about it? After all, much like trading, you are responsible for your actions and if you lose all your money that is between you, your conscience, and your family. But when temptation is too easy, it’s often difficult for people to turn away. And that leads to ever expanding safety nets.

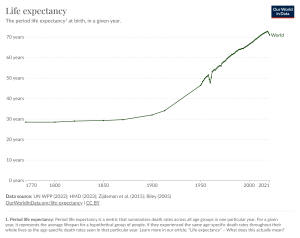

When enough people start going broke from this addiction, the rest of society needs to start helping them out. Whether or not we approve of how they got where they are, we’ll work to find a way to feed, clothe, and shelter them. This costs me money. I’m personally a fan of the idea of tax money helping, to some extent, those in need. I’d prefer, however, to be able to throw more of our tax money elsewhere to benefit rather than rescue. There are plenty of infrastructure needs lining up for improvement or implementation. Power, transportation – that’s what I want us to be able to spend all that money on.

Look at it this way…If there was really good zero calorie and fat free ice cream, the world might be a different place. Unfortunately, that’s just not how it works. One man’s opinion.