So here we are. No more complacency. Now everyone knows what a black swan is. She’s swimming by as I speak. Interesting thing is, as rare as she is, she’s not the only one. Some are larger, some smaller, some less ‘dark’ perhaps than this one, but we’ve seen them swim by before. They’re those things we don’t see coming…and we’re generally glad when they leave ‘cuz they’re ugly, at least on the surface.

What am I talking about? The current market conditions. I can’t and therefore won’t speak to the health ramifications and related issues. There are people that do that every day and know way more than I do. What I do know about is market events. They do happen. With an interesting degree of regularity. For one would think that some of these events should be remembered longer; should be felt longer. These events create pain. They create financial pain that easily leads to mental pain that, unfortunately, even more easily can lead to physical pain. And yet, we forget them. Probably healthier in many ways. Let’s us move forward. Maybe some sort of reaction to economic PTSD.

Please don’t think I’m using that term lightly or with any degree of sarcasm. When you lose a job, when you lose a house, when you worry about your family’s future as the result of an economic event, I have to argue this counts as PTSD. But one of the positives of the economic kind of shock and lingering syndrome, is that we suffer as a group and recover as a group. And economics, unlike emotions, seem to recover every time. Like the swans themselves, you don’t know how long that recovery will take. But you know it will come. Remember those pendulums we discussed a little while back? If ever there was an extreme, this is it.

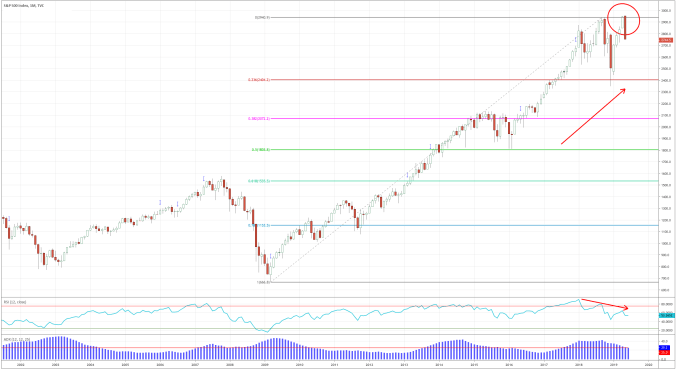

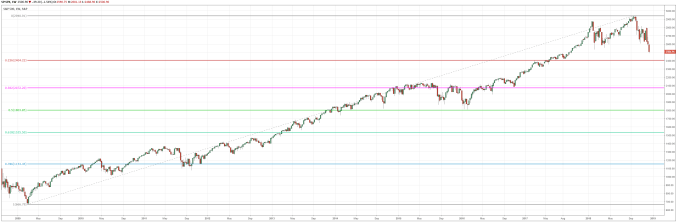

In just over 40 years, we’ve seen the Crash of ’87, the Internet Bubble of 2000, the Great Recession of 2008, and now this. Pretty regular. And each time, we think this is the time we won’t recover. Each time, we wonder how we ever let it get that far away from us. How did we not know this was coming? Well, we didn’t want to. Having way too much fun. Bring up things like portfolio insurance and hedges, all of a sudden you’re the ‘Debbie Downer’ of the party. Why would I hedge when I can make so much more this way? It’s all going up. It’s not gonna go down. And when it does, we’ll all know it.

Pick any of the above years. Same words each time. First time, I was one of the crowd. Second time, thought I heard an echo. Third time, knew I’ve seen the movie, just wasn’t in a position to capitalize. This time? I’m keeping my perspective and I’m doing my homework. It’s not going to be easy. But opportunities will present themselves. Many of those will seem obvious when looking back in a few years. Things like lots of “Pandemic Babies” feeding infant supply companies…everyone needs a diaper when they start. Sounds humorous, but we’re all home these days.

I remember 9/11 babies. And every year, and the victorious city, nine months after the super bowl is this crazy increase in births. All within a week. Go figure. Misery, fear and celebrations all leading to the same conclusion; rebirth. And as corny as it sounds, that’s what we’re going to observe on an economic basis. People will act slower, will do more research, will run lots of ‘what if’ scenarios in their heads, but in the end, they’ll still buy houses, cars, trips and all the same things they’ve bought before. And like those consumers, investors also need to add that extra level of analysis. But start with common sense. Start with perspective.

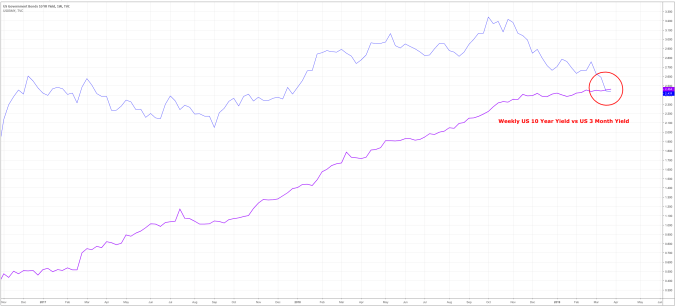

Recessions last an average of 6 – 9 months. And let’s not fool ourselves, with the equity markets down 30% from the peak, interest rates forced to zero and earnings thrown into question for a few months, avoiding a recession would be a much larger surprise than entering one. The job market alone will be frozen for the next 2 – 3 months. Just the act of interviewing is thrown into disarray. Companies can’t hire when they can’t interview. Heck, right now they don’t even know if their network infrastructures can handle the employees they have…when everyone is working from home.

So take some time. You’ve got it now. Rediscover conversation with family and friends. Might as well. Can only binge so many streamed shows before you need some human interaction. And that could lead to investment ideas. One person brings up diapers as an investment, maybe another says people will take vacations again in six months…cruise industry maybe a longer wait. The point is there are and will be opportunities and some people will take advantage of. And it doesn’t need to be the professionals. Sometimes they miss the most obvious winners. Even I’ll admit that not all great investment and trading ideas are borne out of charts (as much as I’d like to think they all are). Much of it is common sense. Much of it is just a bit of thought. And all of it comes back to my favorite word, uttered in this blog of mine many times; Perspective…this time mixed with some Patience.