This one’s been tough. I generally look for a pertinent news piece or an event, even as simple as a plane flight, to trigger a topic I’d like to cover that is relevant to the markets or trading and investing. It hasn’t been easy the last couple of weeks to get that spark. I don’t think anyone would be surprised, given that the daily headlines and much of our daily conversations revolve around the first 2 weeks of the Trump presidency, and speculation about what the next 4 years (- 2 weeks) will bring. These discussions seem completely focused around politics and the unfortunate us vs. them our country has become. We’re as separated as we’ve been in a while, but while unfortunate and disappointing on a personal and social level for many, there is more to it than just right vs. left, with a few curveballs thrown in.

I realized that this is the most pertinent topic out there. Not to inject my political opinions or leanings, and certainly not to editorialize on the moves President Trump has made. Honestly, I can debate both sides of many of them to some extent. Thank you high school debate class. But all of what’s going on in the news, as divorced as it may often seem from our business conversations, is affecting us all monetarily on a daily basis. And yes, there are cycles and trends at work as there always are, you just have to want to get away from much of what is headlines, and look at the same things we always do. It’s been more difficult as it’s all just moving a bit faster these days.

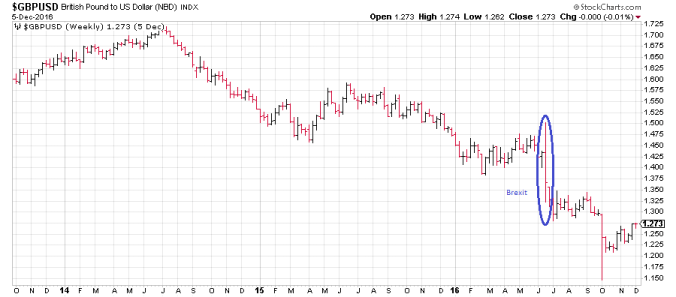

You may have missed some of the stories out there related to what we try and do, have an advantage in our decisions, or at least learn more perspectives and seek more information before making decisions. We can start with the US Dollar. From the chart below we see two things very quickly. First, the dollar is almost exactly where it was when the election was held. So we’ve survived the news cycles both pre and post inauguration and effectively gone nowhere. Second, we’re 4% off the high reached the first week of the year. Not a major correction by any means, but it certainly has the chart looking less bullish in the short term.

The major market indices are trading at record highs. Overall perception (which of course is reality) is not that the sky is falling. Respected technicians, Louis Yamada among them, are calling for corrections before we head even higher. At the same time, it is not difficult to find calls for doom and gloom. I won’t argue against a gold rally (I’m a gold bug at heart) but I’m not sure I’m on board with the gloom and doom crash ahead.

We’ve got Snap Inc., parent of Snap Chat, indispensable to my previously mentioned 15 year old daughter market signal, looking forward to a $3 Billion IPO. Crude Oil is near the top of its recent range with many calling for a breakout. I personally think crude is a great mean reverting market by nature once it’s found a range, so I’m not a believer. Doesn’t make me right…Does make a tradeable time in that market.

In the area of cool things that always catch my attention, Lady Gaga had a spectacular show including over 300 synchronized drones. Way cooler than synchronized swimming, and much more important to so much of our corporate future and lives in general. There is no current shortage of articles about self-driving cars. I think that these will be like cell phones, going from gimmick to integral part of our lives in less time than anyone would have imagined. From fascination to need at 100 mph. And when you really want to learn about something that will affect the way we live and work, check out the newest WOW! The Hyperloop. With Elon Musk helping drive this one (pun intended), I’m not going to be the one that doubts the viability, or the timetable for when you and I can use it.

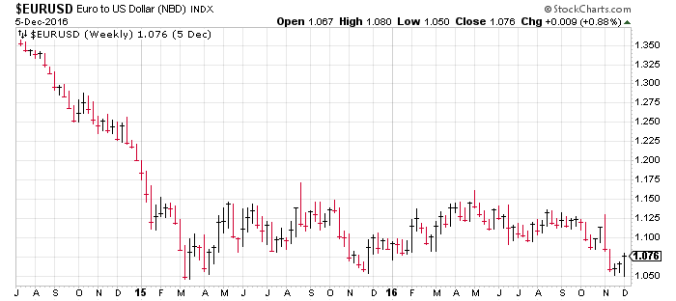

My point is, we are easily distracted, and the media on both sides is doing a great job of grabbing our short attention spans. But success in investing and the markets is driven by getting past the distractions. Most often, the volume isn’t as loud, but the noise always exists. As always though, there are plenty of places to look for opportunity. There are plenty of ways to conduct traditional research and analysis, or if you’re more of a gambler by nature, take a shot. The difficult part is having confidence in the tools that have always worked for you, and understanding that they are more powerful than network news cycles. IPO’s like Snap deserve attention and analysis. Earnings season will always be earnings season. These are constants. They are constants with Republicans or Democrats having the power in our government. They are constants through foreign currency manipulation accusations. And keeping an eye on trade agreements has always been an important thing to consider.

I always go back to my charts, because they help me filter the noise. Others tell me it’s voo-doo, and that’s fine as well. Different techniques breed different opinions. Different opinions breed active and healthy markets. In my last blog, I touched on making a plan. If a type of plan has worked for you previously, then focus on that same type of plan. Understand that it has worked for you before. It may not work every time, but it will work again. Be consistent. Put on some noise cancelling headphones (figuratively). Set them to pick up the information that you find pertinent, and cancel out the rest. There will always be noise. Sometimes quieter, sometimes louder. It’s still noise as it pertains to your investment decisions. Politics unto itself is not noise. It drives our economy. The hard part is figuring out what are the drivers and what is noise…to you. But through it all is opportunity. And that is what we’re after. Now find it, and you will quickly realize that all that our country is going through, on an investment basis, is giving you information to absorb, process, and hopefully profit from. Then sit back and take in the rest of the noise. Act on it socially if that is what drives you, but don’t let it interfere with your investment plans and goals.