I have been finding it extremely difficult to come up with topics that will not lead to people (on one side or the other or both) flaming me for taking a side politically in a blog that is intended to promote thought without inserting a political opinion. But then, as so often happens over the last 10 years, crypto comes flying in with something to write about. The gift that keeps on giving. Here goes:

One on side we have; Crypto is over, It’s crash and burn time, We warned you it was just like tulips, yada, yada, yada…again.

On the other side we have the usual crypto refrain; ‘When in doubt, Zoom Out.’ The phrase is a way of saying a longer-term view will change your opinion what you’re seeing in the short term. This idea comes from, yes folks, charts!

Obviously, anyone who has even casually paid attention to my blog knows I’m not in the first camp. To some extent, I’m actually not in the second one either (Surprise!), though overall those are definitely my peeps.

So, let’s explore both sides of the current arguments. First, crypto is dead. As I have been doing since Bitcoin dropped from around $1200 in 2013 to under $200 in 2015, I’m going to declare crypto is not dead. I’m not even sure it’s sick. It’s actually starting to try and grow up. How can I say that after this current sell-off from almost $110,000 to under $80,000 in mere weeks?

I still look at crypto as evolution of a blockchain, as I have when I was first introduced to bitcoin in 2012. In that light, it’s not going away. Meme(shit) coins? They can go away. The opinion out of Washington this week that shitcoins are collectibles actually makes some sense to me. Kind of like Pokémon. I might have to start actually referring to them as meme coins now. The hard part is determining when a meme coin essentially gains utilitarian value of some sort and is no longer a shit, I mean meme coin. But this is a meaningful step forward, so I’ll take it.

Now this sell-off? C’mon folks, no market goes straight up without ever looking back, rocket emoji’s or no rocket emoji’s. 🚀 Have you not been paying attention to this space for the last 50 something blogs I’ve written? Market pullbacks, while at times violent, are not only healthy but actually necessary. That’s how you avoid the tulip thing. By getting rid of the tag-along lemmings and giving new buyers a chance to play.

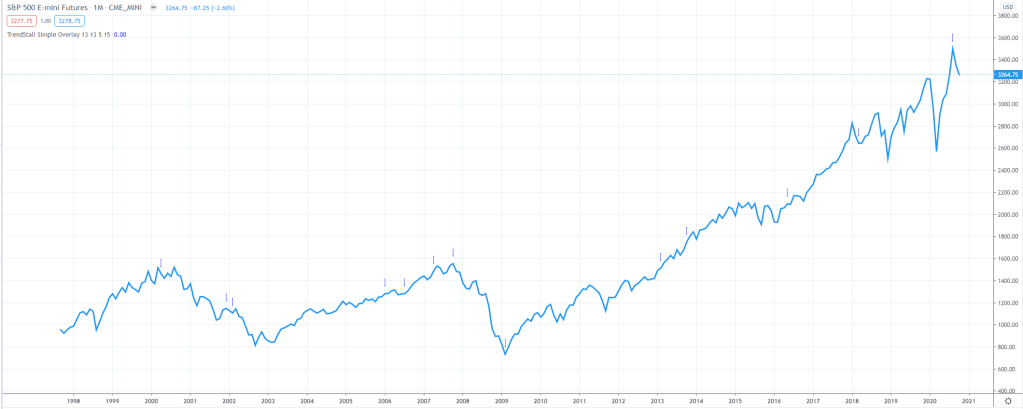

Look at anything that you consider a ‘bullish’ chart. There were stumbles, even some falls along the way. Yet, stuff still has managed to set all time-highs recently. No, not crypto silly, the S&P, the Dow, etc.…you know the stuff my mom refers to as ‘the market.’ The thing is we get conditioned to things going up, it’s kind of the idea behind the stock market, pensions, 401k’s etc. When things do go down, it’s often much faster than they go up; and that’s not just crypto. While we can talk about weak holders, stop orders, and the like, I generally just chalk it up to gravity at work.

Ok, so now we’ve covered the ‘Crypto is Dead’ piece to a decent extent to find it acts like almost any market. Don’t believe that the drops are as violent in other markets as they are in crypto? Have a look at commodity Futures sometime. Pick a future, any future. Metals? Look at Silver. Energy? Look at Natural Gas. Not convinced? The price of Frozen Concentrated Orange Juice, the Futures of Trading Places fame, declined by 60% over the last 2 months! We’ve been drinking OJ for a long time. The ups and downs of the Futures market may ebb and flow, and the amount we drink may do the same, but society doesn’t as a whole doesn’t stop drinking orange juice altogether when prices go up. Some people do, and this in turn gives the market some new breathing room.

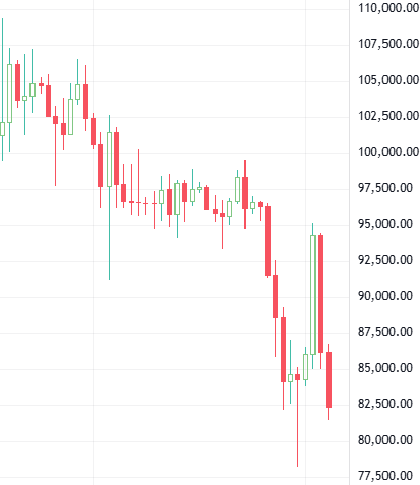

So now back to crypto crowd and their mantra of When in Doubt, Zoom Out. This recent sell off is a great time to actually see what this looks like!

Well, that’s pretty ugly. That’s a daily Bitcoin chart for the last couple of months. It may even be bordering on f’ugly (you can figure out what that means…). If we do the math, Bitcoin dropped 28.5% in a little over 5 weeks. Orange Juice does that without breaking a sweat as we just learned. Is this the bottom for Bitcoin? If it is, my timing is more luck than anything else. But what it isn’t is the end of crypto. Let’s do that Zoom Out thing, shall we?

Almost 10 years of Bitcoin history (monthly chart candles). We can definitely look at it and say ‘We’ve seen this movie before.’ One thing that jumps out, to a chart nerd like me anyway, is that the most recent big green up candle in November had a bigger range up than the just finished February down candle. Maybe gravity and physics are not the most powerful forces here. Nope, just lemmings and human nature and money. Piling into a trade then gate crashing the exits to get out. Notice I used the word trade in that sentence, not investment. And that’s why I’m not convinced this is the end, even if there is not, I’m sure, a shortage of people licking their wounds from this last drop.

Here we are looking at the same monthly Bitcoin chart built on a logarithmic ‘log’ scale vs the previous linear scale, which gives an even different and to many, a better perspective. Given the history, this move actually looks rather tame. We could add lots of Technical Analysis derivative indicators to the chart to help expound on the why’s and when’s of the moves above, but there’s really not much need. It goes up. Not rocket ship up, but still up.

I will also point out that there are many that will find a buying opportunity somewhere. It may be lower, it may be higher, but those opportunities will be plentiful, though they are rarely easy. This is what sustains markets, has helped sustain crypto for more than the time I’ve been involved even, and will continue to keep the crypto markets, as well as others like Frozen Concentrated OJ Futures, healthy.

In case you’re new around here, let me reiterate my ‘opinion.’ Same as it was when I was first introduced to Bitcoin in 2012. I’m bullish. Back then, it wasn’t due to charts – didn’t have good data, but rather fundamentals. And that also has not changed. For while I do focus on charts and technical analysis, there is IMHO, sound fundamental reasoning behind cryptocurrencies. No, it does not center around illicit activities like Silk Road (one of those down moves on the chart) if that’s what you were thinking. Actually, different fundamentals, and different illicit activities that include Al Capone as an example. As I look back, I’m astonished that I haven’t covered that part yet, though I did touch on it briefly here.

I think I’ll just let you ponder the connection until the next time…