…Or the computer screen, or the cell phone. Unless it’s to put on some meaningless background noise. That’s what we did in the prop trading shop. We rarely had CNBC or Bloomberg TV on. Generally, we tuned into sports, Netflix, that type of thing. Something you could ignore. Business channels? Maybe if there were interesting things going on. This would probably have been one of those times.

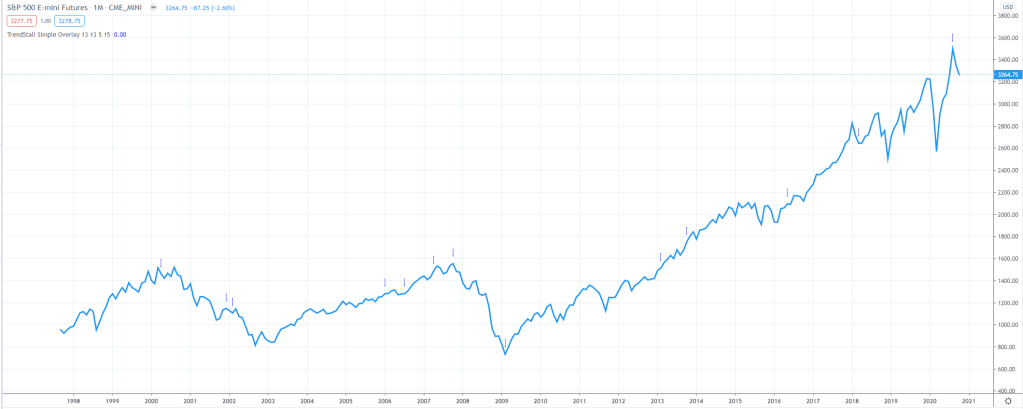

Traders have often latched onto the saying attributed to Confucius, ‘May you live in interesting times.’ Blessing and a curse. To a market maker like I was, volatility was something we looked forward to. But as you’ve probably gathered from previous blogs, we were a different breed. Like people that love the biggest roller coaster you can find (me), vs sane people. And it’s not just the old pit traders from the floor. The early days of screen trading had tons of opportunity for that style of trading. Now? It’s awfully tough for a person to compete with the speed of machines. It’s really why I preach to you, my readers, to not gauge your success on a daily basis. Look at trading, or investing is an even better term, as a long-term game proposition. That’s something that has yet to go out of style.

Meanwhile, back to the television. The thing about our prop trading office was that we didn’t trade off of the host’s discussions that tried to explain sudden news or even, for the most part, off of the news headline itself. We would switch to CNBC, however, when something new did come out (flashing on our screen), so you would at least have a basic understanding of why your trades, win or lose, went the way they did. You’d hear someone say something and stop to listen briefly. It’s a bit of a talent to filter noise while still being able to grab the occasional important tidbit. Or maybe it was ADHD. But either way, the stops were in. Now move on to the next trade.

Other than the very, very small community of insane traders, the thing that virtually everyone that interacts with markets does not want is extreme volatility. Pick a direction. Progress, up or down, over time. I’ve been asking friends/colleagues in the finance world how their necks are. It’s really a type of mental whiplash. The constant knee jerk back and forth will destroy any trading strategy. In crypto, people look at how many positions, or how much nominal capital losses were stopped out, or ‘liquidated.’ I don’t consider watching others lose money a sport. I will say that crypto has not been shielded from what’s going on in traditional markets right now either.

But it’s exactly those traditional markets moves that are leading to stories you’re reading. I’m not passing judgement on tariffs or any other current market moving news. I am passing judgement on surprises. They’re bad. And when they rock the bond market, they can be really bad. Why. (Yes, I know there should usually be a ? to end that sentence; this time it’s a statement)

Because bonds are different. Interest rates are different. I’ve written a blog on the slow movement of interest rates. I followed up by admitting that, in that instance, I was wrong. The Fed moved one way then shortly later moved the other. When thinking about interest rates, it’s easy to understand why these are generally long term ‘trending’ markets. Because long term decisions are made based on the expectations of interest rates. Should I buy a house now? Will lower mortgage rates a year from now position me to buy a larger one? Or in my first choice of neighborhood? Or, will I be upset if I don’t pay over asking for this house now because next year interest rates may not allow me to buy it at all. Everyday decisions for everyday people.

Businesses, from small to large corporations, also can end up successful or not based on interest rates. To put it in business or economic terms, what is my cost of money. If I borrow to buy some new equipment for my neighborhood store, or build a new factory for my large industrial corporation, how much does it cost me each month? Business decisions for business people. Same thoughts, just different scale.

So that’s it. That’s why what’s going on around us is, to me, more f’d messed up than usual. Because it’s surprise after surprise after surprise. Usually when these types of things happen, it’s one surprise. Granted, one BIG surprise, but then it’s done. Mortgage meltdowns. The Bernie Madoff events that cause instant selling (or buying) before cooler heads prevail. So what’s the answer?

Where we started. Don’t make trading decisions based on the news of the minute. How do you avoid it? Watch, read or listen as you would to other news stories. Crazy weather occurrences. Royal coronations. Your town’s high school won the state championships. P-Diddy; well, maybe not that one. But you get the idea. This is important news, no denying it. It can and will impact all of us. No denying that either. But we can’t let it impact our outlook on a momentary basis, because in the next moment, whatever ‘it’ is could be going the other way.

This is one of the times where you have two choices; well, three if you count losing all your money as one of them. The other two choices are, Sit on Your Hands or Shut Out the Noise. Sitting on your hands means you’ve made decisions before based on information gleaned over time, technical charts or fundamentals, so expect them to still play out, over time. Unfortunately, that time may be longer and a much bumpier ride than you initially expected.

Second, shut out the noise. Like when we’ve spoken about Discipline being SIN’s #1 Rule, this one is much easier said than done. You can start by turning off financial television, radio, podcasts…or at least just use them as background noise, as I mentioned earlier. Keep following the people you followed before we hit this volatility, and give them the same respect they’ve earned over time. The ones who just shout out how ‘right’ they were? Yeah, drop ‘em like that bad habit on New Year’s. But stick to this resolution. Or look at it as entertainment. Like professional wrestling. You know they’re full of shit, but it doesn’t mean it can’t be fun to watch.

So that’s how we handle the Surprise of the Day atmosphere we’re living in. Take a step back like always, plan your approach, and stick to your plan. I’ll check back here in the near future and see how everyone’s holding up.