A reader and ex-colleague suggested it’s been a while and I needed to write something. It has been a while, and while thinking about a topic I decided to write about a few topics as my own Year in Review. Don’t worry, it’s not going to be 3x the usual length.

So let’s think about 2023, and I’m going to leave out politics unrelated to financial markets and crytpo because, well, this isn’t a political blog. It’s one about how stuff in the world impacts markets and there’s enough other shit to write about. Like recession, inflation, and back again. Like a terrible job market that is still showing an enormous amount of historic strength. Like the insane electric vehicle growth that didn’t happen. Or even the way suddenly high mortgage rates were going to crash the housing market yet Zillow still tells me my house is worth more on a monthly basis. OK, AI is in there somewhere. And of course, as someone who has been involved as deeply and as long in digital assets a I have, we will discuss Gary Gensler. You didn’t think I’d leave him out, did you?

The big picture; what is going on with our economy. Honestly, I’ve got no friggin’ idea. I can throw out some thoughts and ideas, but like all the ‘pros’ and those making the big decisions (do Fed governors count as pro’s??) I’ve probably been wrong more than right on these predictions. We’ve gone from the easiest money on record, mortgages under 3%, to a peak of 8% in under 2 years. I’m one of those tied to my house forever as I’m paying 2.875%. Thankfully we like living here.

Those rates went along with the rampant and rapid inflation we all felt. Now, it’s not like some of the stories we hear about in South America of 100%+ annual inflation rates, but when Hebrew National hot dog packs go from the traditional 7 hot dogs to 6 (never understood the 7 thing) and a Ben & Jerry’s ‘pint’ is now 15.2 ounces I’m feeling it. So, what’s next for the economy? We’ve supposedly put the crazy rates to rest for now as the Fed is stopping raising rates and all the ‘pros’ (remember them?) are calling for multiple rate cuts in 2024. Soft landing? Recession? Back to that idea of Stagflation? Yeah, I mentioned that one, but the economy is too strong for that one…for now. Definitely no predictions from me, I could pick all three and probably still end up wrong.

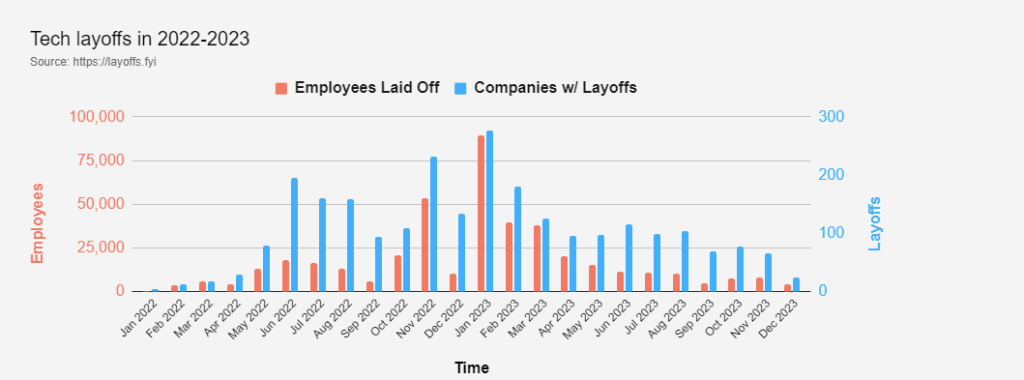

The job market has been kind of all over the map like interest rates. I was, unfortunately, part of a 20% layoff…er, I mean ‘Reduction in Force (RIF)’ this year. It happened as layoffs were being announced weekly, with over 250,00 tech workers (Finance and Crypto included) lost jobs in 2023 alone. When you’re part of the number, it definitely feels like a lot of people.

And yet, the latest reports and the charts say that this was a rapid but relatively brief event. I can personally say that I see the change back from the doom and gloom of six months ago as I look for the next stage of my professional journey. Companies are realizing that they need help and they are really going to survive so it’s time to build for the future. This is In crypto, it’s in traditional finance, ‘trad-fi,’ so I can only figure it’s happening elsewhere as well. Thankfully it allows me to be more selective about what that next stop looks like.

I’m also a car guy, so I’ll lightly touch on electric vehicles. The car makers have planned and built for explosive demand. It was supposed to be the big moment, or at least the beginning of a big moment, for the car industry. Then consumers spoke. We want range; not just claims of range but real range. Over the river and through the woods holiday travel type range. And we want to recharge in the time it takes to stand on line for fast food at the rest stop. A close friend had a Cadillac Lyriq briefly as a loner car. We went out in Hoboken for a couple of hours. After we were done, the car showed it had charged enough to drive for around 60 more miles than when we started. This was not fast food so we’re definitely not there yet.

Other issues? Well, insurance companies are starting to realize that repairing electric cars is not like fixing your father’s Oldsmobile. These things get totaled constantly. Tesla batteries help actually stiffen the car but they are a lot more expensive to replace than realigning an old school car frame, and insurance rates are starting to reflect that. It’s not a recipe for consumer adoption with all that inflation going on…

Housing? I don’t think I need to point out what’s happening. Either you can’t afford to buy a house because of the high rates or you can’t afford to sell one because of the high rates. It’s kind of a Catch-22. So new stuff goes up; around here it’s townhouses. Sure makes my house with a yard more valuable to a lot of people. But as I said, it’s not for sale…well…everything has a price, hence my monthly ‘theoretical’ increases in value.

This one is interesting because should rates go down, my house becomes more affordable to more people. That’s what led to the last round of bidding wars. As those of you who know me, or have read a bunch of these blogs, I’m not going to say real estate can’t go down. Especially when everyone else seems to have thrown in the towel on that one and just accepts the steady increase. But short of a real ugly recession, how does this happen? Hmmm…I do hope that wasn’t prescient…

AI really stole our attention this year. Depending on the font, you may think that’s short for Allan. Actually we’re talking about artificial intelligence. I vividly remember 2-3 years ago being told college is dead, kids just need learn to code. Fast forward to 2023 and every engineer I talk to is convinced that computers will write code faster and better than humans. Personally, with some debugging (Product Managers do a lot of that) I’ve gotten ChatGPT to help me write some awesome code for my personal use. Way easier than learning multiple computer languages.

There’s plenty to be scared of with AI, but also plenty to be excited about. Healthcare will benefit in ways we can only dream of. Financially supporting all these people that will live longer and (supposedly) need to work less is definitely something worth discussing, but I’ll reserve an entire blog for that…next topic picked! Personally, I’d like to not worry about cancer. Or to have better solutions for my spinal issues. Even better weather reporting and things we don’t necessarily ponder daily will be greatly improved. Aside from the weather forecasters on TV taking less crap for constantly being wrong, predicting things like hurricanes, blizzards and everything in between more reliably will save lives on a regular basis. I could go on, but like I said, another blog.

Ok, crypto…with a touch of Gensler. A year ago, crypto was dead. Again. Crypto winter. No one has a use for it. I call bullshit. No doubt a lot of small crypto start-ups ran out of money, or thought they might and had layoffs. But the folks that are going to make digital assets a part of not only my everyday life but yours as well, were building. And building. And building. Thankfully we had AI taking all the attention so it could be done properly, which often means quietly.

Traditional finance players and the crypto kids alike are all working on ‘tokenization’ of assets. What does this mean? Like much of the digital space it means better record keeping, more reliable proof of ownership, and eventually more control over things you own. I try to preach that this is all evolutionary not revolutionary, so when you turn around in 5 years and everything is accessible to you and no one else simply through your phone, you can remember this paragraph. We used to wonder what we would do with an ‘Internet,’ now we struggle to understand how we’d function without one.

Unfortunately though, like most roads these days, this one has potholes. One of those potholes even has a name; Gary Gensler. It is amazing in a society built on not letting one person have too much power, we have this person standing in the way of what so many are looking for, defined regulation. It’s interesting to me because my Political Science major had me on the side that a government’s job is largely to protect people from themselves. This is what the SEC is there for. To tell us how to not be dumb enough with our money to lose it all. So, we’re all asking for some rules to help that happen. The SEC needs to realize that digital assets are not going away.

The people are speaking and have spoken. In fact, the US is falling behind. The EU and Great Britain are working with the industry to figure out how to make crypto as safe as other assets. The SEC under Gensler is acting like a petulant child that owns the only ball on the block and doesn’t want anyone else to play with it because no one is picking him first for their team. We’re all in this together, Gary. Stop saying ‘La, La, La I can’t hear you’, and listen. Regulation by random enforcement is not the long-term answer. There’s a lot of smart people working on this stuff, I’m sure there are many other solutions that can achieve your supposed goals, it’s time to find one.

So that’s it. That’s my summary. A bit longer than usual, but hopefully worth the read. The only prediction I will make is that next year will hold just as many surprises and we’ll all be wrong with our predictions. Or most of us will be. I’m confident I would be, so I’ll pass for now. Just gonna wish everyone the best going into the new year. I appreciate everyone that takes the time to read this, and hope I can keep you interested in 2024…and maybe even post a bit more often.