The VIX has been pretty boring lately. That’s pretty easy to agree on. Which in turn means the S&P has been pretty boring. In this case, the S&P being boring means it keeps going up. Now I’m a very big fan of boring. I’ve told students, I’ve told clients, if steadily making money is boring, then every day you should strive for boring. Boring should be your investing and trading mission.

But for some reason we don’t like boring. It doesn’t feel as fun if the market just goes up. If you just make money every day, where’s the great story to tell. So unless you are one of the few who are happy making money in a boring way, we need to find another playground.

And like an early present for the holiday season, here come bitcoin index futures listed on the Chicago Mercantile Exchange. Yes a real, regulated, US fully legal trading instrument based on that “thing” that would only be used by criminals. Remember those days? Silk Road, Dark Web, or nerd. Those were the only places bitcoin belonged, or so it went. And now that it’s worth over $7,000, everyone wants to play, and now they can.

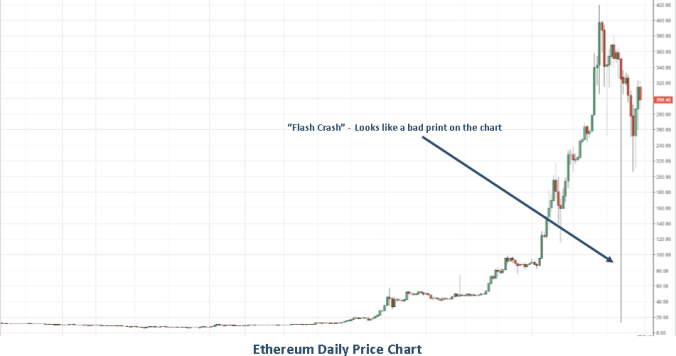

I find it a bit ironic that at the same time that the S&P 500 is boring, the exchange that introduced us to the world of index futures trading is launching what promises to be a contract that will be anything BUT boring. Bitcoin prices aren’t in the news on a regular basis because they’re boring. Bitcoin prices are up 10x in the last year. So these prices are up and not boring! We all want that right? Well, maybe…

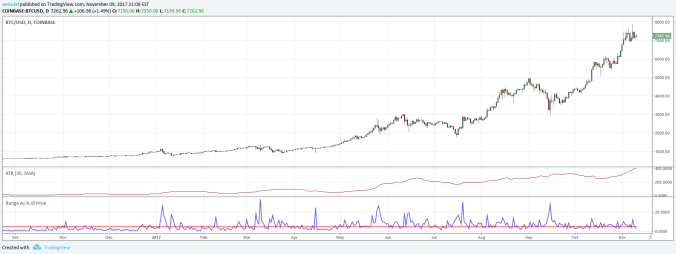

Let’s look at the argument against excitement. The average 24 range of bitcoin over the last month is approximately $400.00. That’s significantly higher than what you’ll find on a boring index like the S&P. The chart below gives a good amount of information about what constitutes ‘exciting.’ The top chart is the basic chart of bitcoin prices over the last 12 months. The second chart is the average range of the daily price, from high to low, over the trailing 30 calendar days, which in the case of bitcoin is one month. Remember, that’s even more bang for your buck…you can live the excitement of bitcoin every day, not just Sunday night through Friday afternoon, like the S&P index. The third chart shows the same range as a percentage of the previous day’s close, with a reference line at 5%. It’s not an irregular day to have a range beyond 5%.

We can look at the same three charts as they relate to the S&P 500. The charts pictured are the actively traded e-mini futures contract. The Average Range chart is using 21 days instead of the same 30 from the bitcoin chart as a month of trading the S&P is approximately 21 days. The bottom chart of daily range as percent of price has been altered such that the red line is set at 2% vs. the 5% line we had used for the bitcoin chart. And yet, we have trouble breaking it even on occasion, to say nothing of a regular basis.

I understand as someone that uses charts on a daily basis that some of this does not always make itself apparent in understandable ways to those not looking at the continuous comparisons these pictures allow. And after all, I’m the first to admit charts themselves are Boring, so if we’re on the topic of excitement, I’m going about this all wrong.

Let’s look at this in money terms. The only thing that really matters when it comes to these discussions of profit and loss. There are no words in the statement “profit and loss” that have anything to do with something other than making (or losing) money. So let’s do our comparison in those terms. We can start with that mini S&P index, as it’s the most familiar price other than The Dow when discussing overall markets.

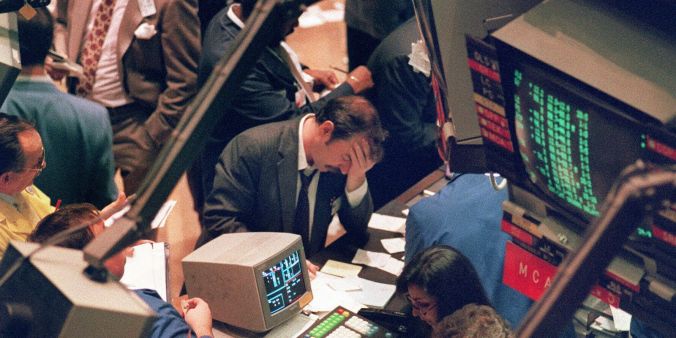

The average 21 day range in the e-mini is around 13.5 full points. In fact on November 8, the high was 2592.50 and the low was 2579.50, a range of 12.75 points, pretty close to the current average. The dollar value of a move in the e-mini contract is $50, so 13.5 point range works out to a swing of $675 on one futures contract. By comparison, the new CME bitcoin index “BTC” contract has a contract size of 5 bitcoin/contract. Therefore, a $1 move in bitcoin is marked by a $5 per contract change in your account value. So the current average daily range of $400 translates to a daily P&L equivalent of $2,000 per day. And that’s on average. And that’s more volatility than most stomachs can realistically handle. It’s the balance of Fear & Greed on a daily basis. And you can never underestimate the effects of the Fear side of it.

Still bored? That’s the point of this one. Boring can be good. If you need sleep you go for boring. Tired? Fireworks show or golf on television? I’m going with TV golf. Boring in that case, is good. Boring helps you sleep when you need it. Exciting usually means losing sleep. Now this can be good. Celebrations of any sort often fall into that category. But not every day. Weddings are fun parties. But I don’t want that excitement on a daily basis.

Well get ready, bitcoin is a party of a market every day. And now everyone’s got an invitation! Not everyone can handle all that excitement. Does it have its rewards? Of course! But what does it take to get there? That’s the part that becomes a personal assessment everyone should make before jumping in. These new futures give exposure that many have been looking for. But it’s just a first step. If looking to play these markets, get ready for the amount of fear you will experience; and when it’s in the right balance to your greed factor, that’s the time to step up to this table.

ETF’s, while often leveraged, rarely have the actual dollar swings per unit of ownership that futures do. And an ETF can’t be far behind these index futures. Though ETF’s have been rejected on prior occasions, exchanges are competitors, and like many competitors they get jealous. So don’t be surprised if an ETF on bitcoin or other cryptocurrency is approved soon to trade on an equity. Because for now, all the US regulated cryptocurrency trading will be in futures based off of a bitcoin index price. And that’s really exciting! But if you want to invest in these markets, and don’t crave your craziest college parties every single day, have a bit more patience. Your entry ticket won’t be far behind, and it might actually give you a much more tolerable balance of exciting and boring.

The number of people delinquent on car loans is at a high. Subprime auto loans have exploded, and delinquency rates on those loans as calculated by Morgan Stanley Research is over 4.5%, and close to the level reached during the financial crisis. While not near the cost of a home loan default on the economy, cars are one of the larger purchases most people make.

The number of people delinquent on car loans is at a high. Subprime auto loans have exploded, and delinquency rates on those loans as calculated by Morgan Stanley Research is over 4.5%, and close to the level reached during the financial crisis. While not near the cost of a home loan default on the economy, cars are one of the larger purchases most people make.